Enterprise-class technology sales in the restaurant industry entered 2025 under the weight of historic pressure: razor-thin margins, persistent inflationary cost dynamics, and an operator community determined to spend only where value was proven. For many vendors, this translated to the longest, most complex buying cycles in memory — and for enterprise buyers, the most deliberate and risk-averse decision-making environment in years.

But 2025 was not a pause in adoption, it was a reset in how restaurants buy. Understanding that reset is essential for vendors and operators alike as we head into 2026 with renewed investment confidence but enduring scrutiny.

The State of Restaurant Tech Investment in 2025

Despite slower spending patterns, technology remained a priority for the industry when tied clearly to efficiency, cost control, and customer experience rather than novelty. Surveys showed a majority of operators planned to increase technology investment in 2025, with more than half targeting tools that improve operational efficiency and forecasting, including AI and automation.

However, the way restaurants evaluated and purchased tech shifted. Here's what we saw:

-

Technology investments were increasingly subject to rigorous ROI expectations from finance leadership.

-

Operators consolidated stacks into cloud-based, integrated platforms to eliminate point silos.

-

Enterprise brands executed pilots not as proofs of concept but as proofs of value, with tighter governance and clearer success criteria.

At the same time, high-visibility moves, including AI partnerships by major chains such as Yum Brands (Taco Bell/KFC/Pizza Hut) and expanded AI rollouts at Wendy’s drive-thrus, highlighted that advanced technologies can work — when operationally contextualized.

Why the Enterprise Sales Cycle Lengthened in 2025

For enterprise restaurant tech vendors, several converging factors lengthened sales cycles:

-

Multiple stakeholders — operations, finance, IT/security, legal, procurement required alignment before consensus.

-

Risk aversion — post-pandemic uncertainty led buyers to scrutinize integrations, data security, and implementation impacts earlier.

-

Budget discipline — restaurants avoided mid-year spend shifts and preferred roadmap alignment with strategic priorities, slowing approvals.

These dynamics made the process less linear and more multi-phased and iterative than ever.

A Practical View of the 2025 Enterprise Buying Process

While no two deals were identical, the effective cycle shared common phases:

1. Strategic Qualification (Weeks 1–4)

Early vendor engagements had to quickly frame the opportunity in restaurant economics like labor savings, throughput, DJ fault reductions, or guest experience lift.

Operators were not shopping for feature sets. Deals that stalled here usually lacked a clear economic owner or measurable outcome.

2. Stakeholder Alignment (Weeks 4–10)

Top restaurant buyers created a coalition early: ops + IT + finance + procurement.

Vendors that provided a Mutual Action Plan with clear milestones earned credibility; vendors that sold to one champion rarely saw sustained momentum.

3. Evaluation (Weeks 8–16)

Operators compared multiple solutions with heavy emphasis on referenceability (those case studies are important) and operational fit.

Vendors who could quantify historic value gains in real restaurant environments saw faster decisions. Feature comparisons alone were insufficient.

4. Pilot Execution (6–16+ weeks)

Most enterprise deals leaned into pilots not just as demos, but as measured outcomes.

Buyers insisted on clearly defined success criteria up front... a key difference from past cycles where pilots were subjective or open-ended.

And another thing about pilots that we learned... it's imperative that all stakeholders are aware of them happening! We've seen pilots last for two months only to have new stakeholders brought into the project late and create some new challenges.

5. Security, Legal & Procurement (4–12+ weeks)

This phase often reset timelines.

Vendors prepared with SOC 2 documentation, security questionnaires, and clear data flow diagrams outperformed those who scrambled to answer late-stage questions.

6. Rollout & Expansion (8–26+ weeks)

Implementation readiness became a competitive advantage.

Vendors who invested in onboarding support and operational enablement during the sale phase closed larger footprints and faster expansions.

Real 2025 Industry Examples that Shaped the Market

In addition to survey data, 2025 saw notable enterprise technology initiatives that underscore the evolving adoption environment:

-

Yum Brands launched AI ordering pilots in drive-thru environments across major brands, showcasing customer experience and operational efficiency potential, yet also indicating that such innovations require scale and patience to validate before broad rollout.

-

Wendy’s expanded its voice-AI ordering systems, moving from limited tests to hundreds of drive-thru locations, reflecting growing operator comfort once early pilots achieved operational accuracy.

These examples illuminate the broader reality: enterprise tech adoption continues, but only when value, reliability, integration, and operational fit are proven.

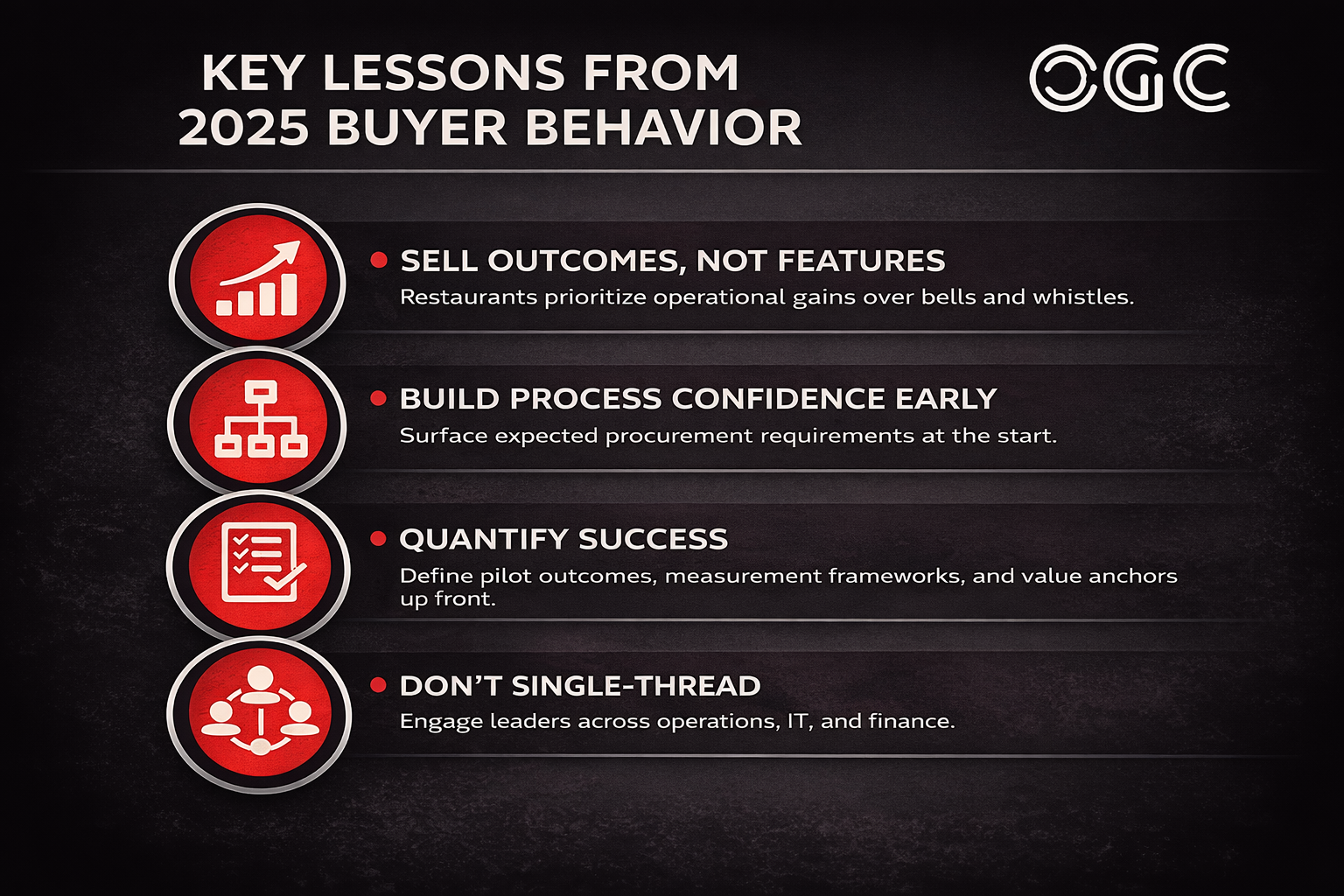

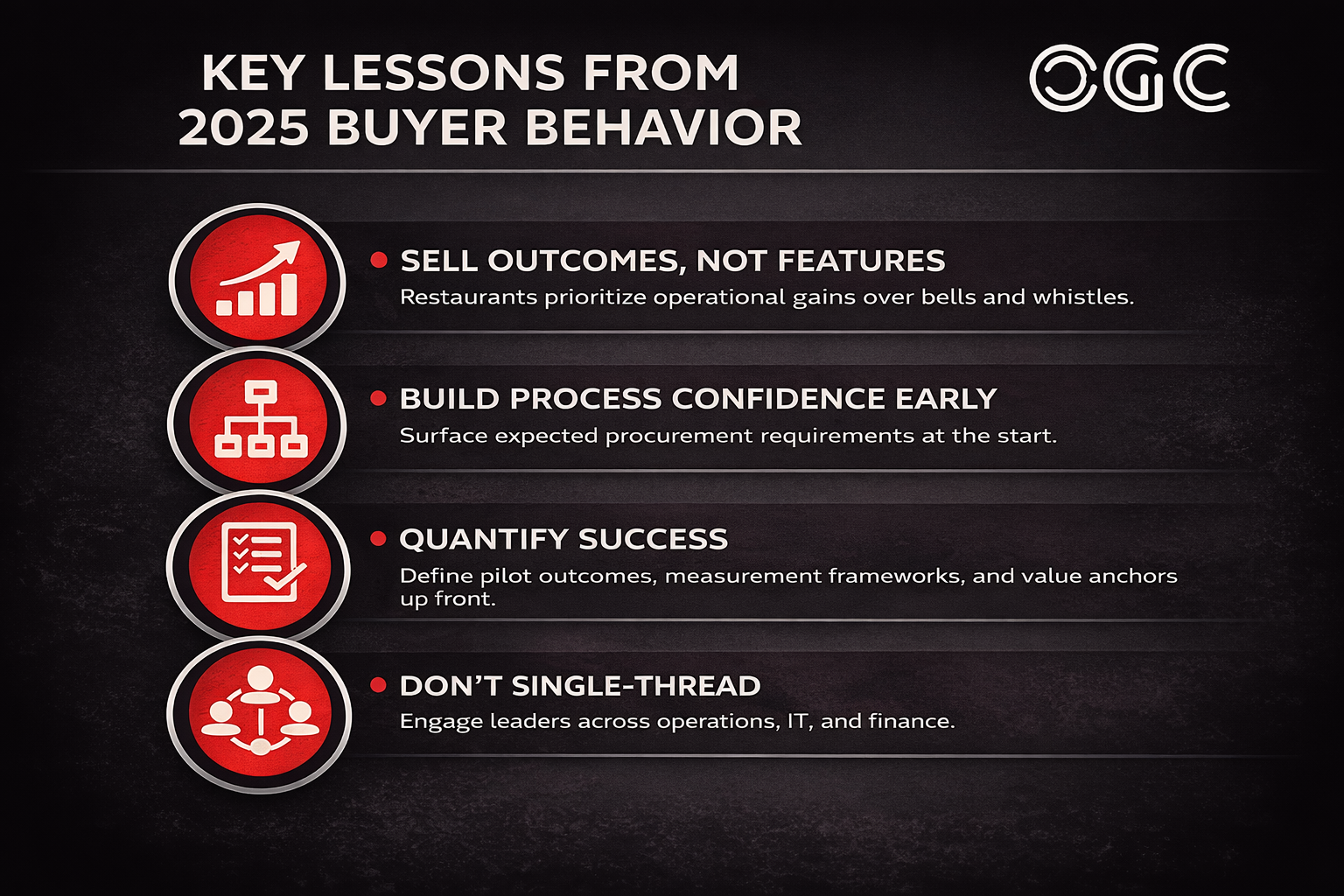

Key Lessons from 2025 Buying Behavior

From these patterns, enterprise vendors should internalize several learnings:

-

Sell outcomes, not features. Restaurants prioritize measurable operational gains over bells and whistles.

-

Build process confidence early. Expected procurement requirements must be surfaced and planned for at the start

-

Quantify success. Define pilot outcomes, measurement frameworks, and value anchors before implementation.

-

Don’t single-thread. Engage leaders across operations, IT, and finance to build consensus and reduce late-stage friction.

These are not optional; they are the hallmarks of winning engagements.

Why Product Rep Firms Like OGC Are a Strategic Advantage in 2026

As enterprise restaurant sales cycles grow more deliberate and more complex, vendors’ ability to execute through the entire process — not just open doors — has become the differentiator.

A reputable product rep firm, like One Goal Consulting, accelerates enterprise success by:

-

Elevating credibility: Operators lean into trusted third-party relationships built on industry experience.

-

Facilitating multi-threaded conversations: OGC helps vendors engage the right stakeholders, avoiding single-champion risk.

-

De-risking sales execution: With a process-oriented approach that anticipates security, legal, and operational concerns, OGC shortens dead zones in the cycle.

-

Driving pilot design that closes: Well-structured, success-aligned pilots become predictable paths to expansion and contract closure.

In an environment where buyers demand proof, certainty, and alignment before signing, having a partner who knows how enterprise restaurant decisions are actually made translates into higher close rates, bigger initial contracts, and faster time-to-value.

Looking Ahead to 2026

Restaurant operators are not retreating from technology; they are taking control of purchase risk. For vendors, mastering the enterprise buying process — and aligning with experts who have seen it executed successfully hundreds of times is a competitive edge in 2026.

The cycle may still be long, but the victories are decisive — and the rewards for vendors and operators who align early and intelligently are real.

If your enterprise pipeline shows interest but stalls in evaluation, risk review, or pilot completion, now is the time to strengthen execution, not hope for faster calendars.

Let OGC help you convert momentum into measured wins this year. Reach out to us for help.